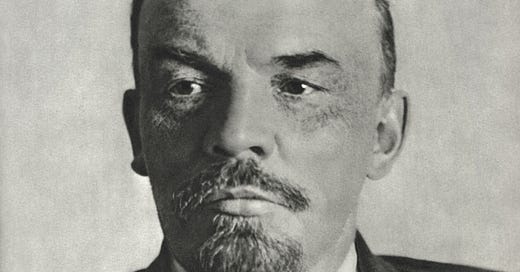

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency,” wrote John Maynard Keynes in 1919. Keynes didn’t cite a specific source. Maybe he thought the adage would sound more threatening coming from the Bolshevik leader than from himself, a disgruntled adviser to the British prime minister at the Paris peace conference.

Donald Trump presumably doesn’t see himself as Lenin, being a fan of capitalism rather than a foe. Yet if he pursues policies he’s suggested, especially regarding the Federal Reserve, he might make Lenin posthumously proud.

America wrestled for more than a century trying to figure out how to manage its money supply. From the 1790s until the 1830s the fight focused on the Bank of the United States, versions one and two. Believers in a strong currency—creditors, generally speaking—defended the national bank as vital to keeping the dollar sound. Advocates of a more flexible currency—debtors—attacked the bank as elitist and antidemocratic. The latter group, led by Andrew Jackson, finally destroyed the bank in the 1830s.

A consequence was an inflationary bubble that burst in 1837, producing the nation’s first serious financial panic. Booms and busts remained a regular feature of American economic life for the rest of the century. The panics of 1857, 1873 and 1893 were followed by depressions, which grew more severe as the country industrialized.

Finally in 1913 Congress created the Federal Reserve system, a modification of the old Bank of the United States. The Fed was tasked with maintaining a sound and stable currency. To enhance its ability to do so, its board of governors was placed beyond the reach of elected officials. The president nominated the Fed governors, who were confirmed by the Senate. But after that the executive and legislative branches had no control over them. The model was federal judges, who likewise had to be free to make unpopular decisions, except that the Fed governors served for ten years (later extended to fourteen years) rather than for life.

Managing the money supply of the world’s largest economy—as America’s had become by this time—was no easy feat. The Fed flubbed during its first decades, most egregiously after the stock market crash of 1929 by allowing the money supply to contract excessively. But since then it has done remarkably well in avoiding recurrent panics like those that preceded its creation. And this despite the job becoming harder than ever after the dollar became the world’s reserve currency following World War II.

The independence of the Fed’s governors from elective politics has been crucial. Presidents have repeatedly tried to jawbone the governors into expanding the money supply before elections, in order to stimulate the economy and make voters feel prosperous. On the whole, the Fed has resisted. The economy has benefited in the long term. In fact, the American economy has been the envy of the world during the century of the Fed’s existence.

Donald Trump has repeatedly expressed dissatisfaction with the Fed and especially the chair of its board of governors, Jerome Powell. Before the recent election he threatened to fire Powell if given the chance.

The president lacks the authority to do so. Yet Trump has shown an ability to make life miserable for those who cross him.

Powell has said he won’t be bullied out of his position before his term ends.

All those who wish the American economy well should hope Powell sticks to his guns and Trump desists. The dollar didn’t achieve its preeminence by accident. Foreign investors seek dollar assets because they have confidence the greenback won’t become a political football. That confidence took decades to develop, but it could evaporate overnight.

It would do so if Trump, by undermining the Fed, accomplishes what Lenin never could.

I (and I assume many of your readers, too) would be interested in your thoughts on the looming national debt crisis. Thanks for your wonderful Substack, Dr. Brands!

An important reminder of one of the many public benefits Americans take for granted. BTW, off topic, did you see Rep. Raskin giving a shout out to your book Our First Civil War: https://slate.com/podcasts/what-next/2024/11/jamie-raskin-is-getting-ready-for-trumps-second-term