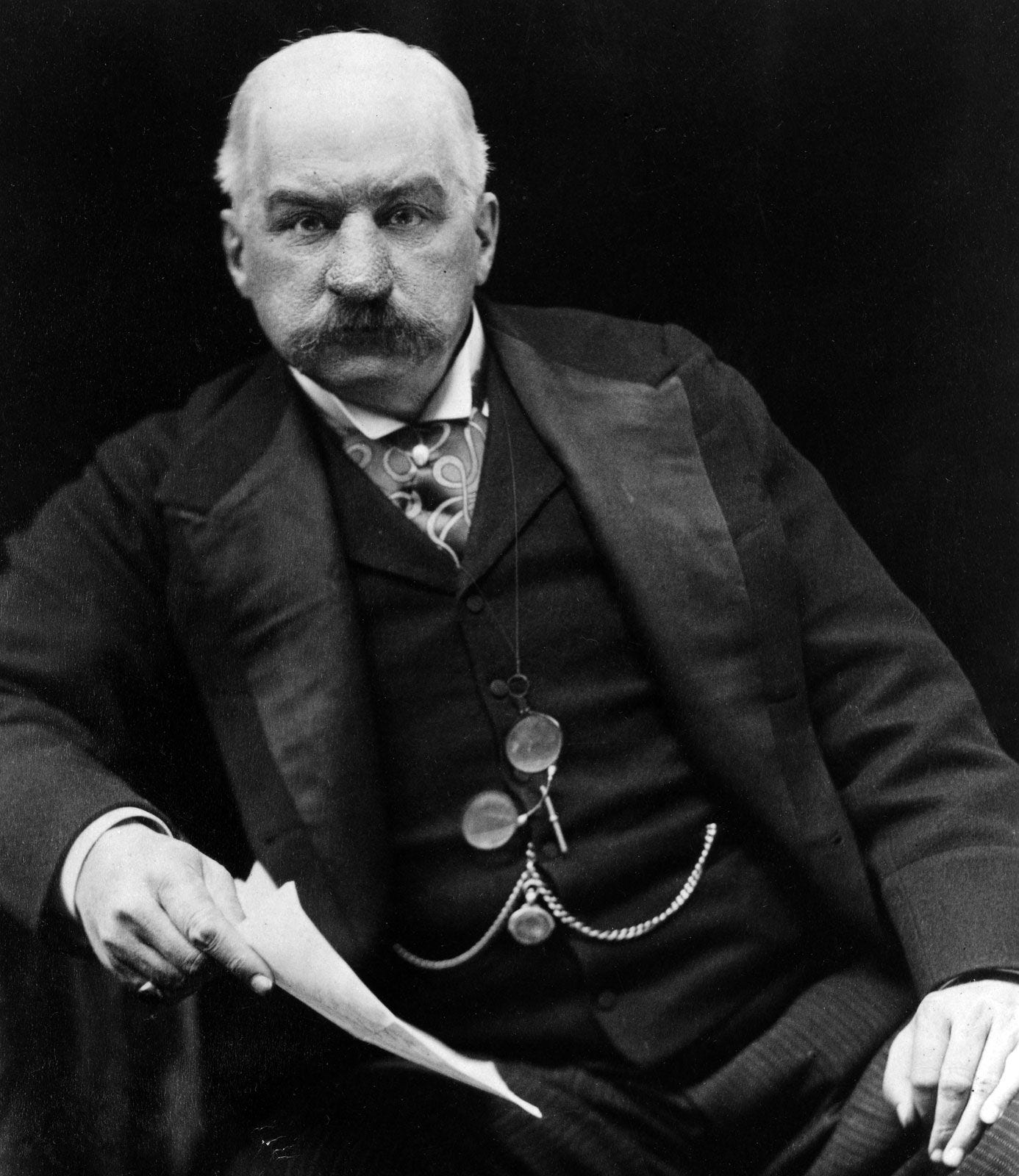

J. P. Morgan, plumber

I work today and earn $100. Tomorrow I can spend it or save it. If I spend it, my spending keeps the economy moving, for it pays vendors for their products and workers for their labor. If I save it, my saving causes a hiccup in the economy. I deprive those vendors and workers of my share of their sales and my contribution to their pay.

At least, that's what happens if I put the $100 in my desk drawer. By contrast, if I deposit it in a bank account, the bank takes it and lends most of it to people who will spend it themselves: on cars, houses, college tuition and any number of other things. Depositing money in a bank is often called saving, but it's different than putting the money in my drawer. It might better be called lending, for I lend the money to the bank and the bank lends the money to the people who spend it in my place. In its effect on the economy, it's almost as good as if I spend it myself. The bank has to hold a little in reserve, and there's a bit of a time lag. But otherwise the economy rolls along.

Another option for my $100 is for me to invest it in a productive enterprise. I could buy a share of stock in a corporation, for example. My money is still being put to productive use, for the corporation is purchasing machines and paying workers.

From my perspective, this form of saving is the riskiest of the three. A year from now the $100 in my drawer will still be there, barring fire or flood. The $100 in my bank will almost certainly be available to me. Bank failures are rare these days, and most losses are covered by deposit insurance. But my $100 share of stock might have fallen in value if the corporation doesn't do well.

Of course I expect to be paid for my risk. The bank pays me interest. At the end of the year my $100 bank deposit might be worth $105. The corporation might pay dividends, but the more common incentive these days is the prospect of a rising share price. My $100 share purchase could be worth $200.

The trick to making all this work is an efficient financial system. If I don't trust the banks and stock markets in my country, I'll put my $100 in my drawer, depriving the rest of the economy of its use. Where banks and stock markets do engender trust, they perform a valuable service, namely transferring money from people who don't want to spend it to people who do. They give life to otherwise dead money.

Which is why people in finance make so much money themselves. They can charge a small fee for individual transactions, but this adds up when multiplied by many transactions. And everybody involved comes out ahead, at least on average. How do we know? Because in this non-compulsory system, no one would engage without a reasonable expectation of advantage.

Nonetheless financiers have often been criticized for growing rich on other people's money. Unlike farmers and factory workers, they don't produce anything—not food to eat, clothes to wear, houses to live in, cars to drive or anything else of substance. Historically they’ve often been the wealthiest people in cities and towns, but they never seem to be working in the way those farmers and factory workers do. They go to the office in coat and tie and never break a sweat. No wonder they've evoked complaint, from the days of the Populist party of the 1890s to the Occupy Wall Street movement of the 2010s.

In fact, they have produced something. Call them the plumbers of the economy. In rich countries we take our plumbing systems for granted. They deliver water where we want it and when we want it. Yet someone had to lay the pipe and build the reservoirs and pump stations, and someone has to maintain it all. When it works, we don't even notice it. But when it fails—when a pump station goes out, when a main breaks, when a filtration plant gets fouled—we realize what a valuable service it provides.

Our financial system is like that. Most of the time it works invisibly. But when it fails, it fails spectacularly. Bank failures were the bane of the American economy from the early 1800s into the 1930s. Stock markets were and still are afflicted by bubbles and collapses.

At such moments many Americans have longed for an earlier time before banks and stock markets became such essential features of the economy. But the longing never lasts, because that era was equivalent to the time before municipal water systems and indoor plumbing. We could go back to wells and buckets and outdoor latrines. We wouldn't need plumbers. But almost no one chooses that lifestyle.

If we got rid of the banks and the stock markets, we’d be less prone to bank panics and stock market collapses. And we wouldn't have to pay the money moguls. But as a nation we’d be much poorer, with all that dead money sitting in drawers rather than being put to use.

The complaints against the financial fat cats haven't been unfounded. They've employed their expertise in the plumbing of finance to fill their own wallets, boosting their fees and persuading government to rescue them from their folly. Competition for thee, monopoly for me has often been their unspoken motto.

Erect no statues to the wizards of Wall Street. The great buildings of the financial district are memorials enough. But neither think we can get along without them. Plumbers do crucial work.

As always, a thought provoking piece by Professor Brands!

I think the term "finance" is being used quite broadly. I agree that banks - and bankers- that are taking in money and lending it out for car and home purchases, etc. are performing a necessary and productive activity.

Where banks fail is when they start getting out of that lane as they did in 2008-9 crashing the economy.

Another aspect to "finance" are literally unproductive, harmful to the economy are private equity, short sellers, and similar Wall Street vultures- yes I use vultures to denigrate these people and activities.

Nobody should be able to bet (yes gamble) on stocks going down in value. That is a ridiculous activity.

Private equity is largely responsible for leveraged buy-outs- another "finance" activity which should be illegal. In the retail sector, over 40% of companies bought by PE in leveraged buy-outs have filed for bankruptcy at some point after their acquisition, according to Retail Dive’s analysis. PE firms borrow the money for the purchase then put that debt onto the company they bought. And if the company was already struggling this adds more pressure.

"Finance" also creates new 'instruments' which again should be illegal or heavily regulated. Collateralized debt obligations (CDOs) should be illegal. Quoting from an article on LinkedIn: "CDOs played a significant role in the 2008 financial crisis through several interconnected mechanisms: Many CDOs were heavily exposed to subprime mortgages, which began defaulting at alarming rates as housing prices declined."

These CDOs sever the link between the home buyer and the bank or lender. If I run into trouble making my mortgage for example, I can go to Huntington Bank and negotiate payments or refinancing. But if my loan is now bundled with some Wall Street package of so-called investments, who do I talk to? That's why many people simply walked away from their homes during the crisis.

Not all "Finance" is equal or value added to the economy- they are simply "rent seeking" in economic terms-getting rich without adding productivity to the economy.

By the way, "rent seeking" largely disappeared from economics lexicon for decades until brought back by Thomas Piketty in his master work "Capital in the 21st Century." Fantastic book!